Tustin Bankruptcy Attorney

Extreme debt can seriously limit your ability to make ends meet or to profitably run a business. Most debt is generated due to a layoff, a serious illness or accident or downturn in the local economy. When debt becomes intense, call a Tustin bankruptcy attorney at (888) 754-9877.

Individuals and business have options when it comes to bankruptcy that a Tustin bankruptcy attorney can review with you. A Chapter 7 will allow individuals and Tustin businesses to discharge business and consumer debt. Assets may be at risk but consumers are entitled to certain exemptions that a Tustin bankruptcy attorney will affirm. They must also meet eligibility standards that a Tustin bankruptcy attorney will also verify.

Individuals and sole proprietors can file Chapter 13 and other businesses can elect Chapter 11, both repayment programs where a Tustin bankruptcy lawyer can adjust debt. These filings allow businesses to continue operating and debtors to retain their assets.

A Tustin bankruptcy lawyer will represent individuals and businesses in any of these types of bankruptcy.

Chapter 7 Bankruptcy

Under Chapter 7, consumer debt such as substantial credit card charges, medical bills, department store bills, personal loans, promissory notes, business debt, payday loans and repossession deficiencies can be canceled. Business assets are sold to pay creditors but have no recourse to recover deficiencies.

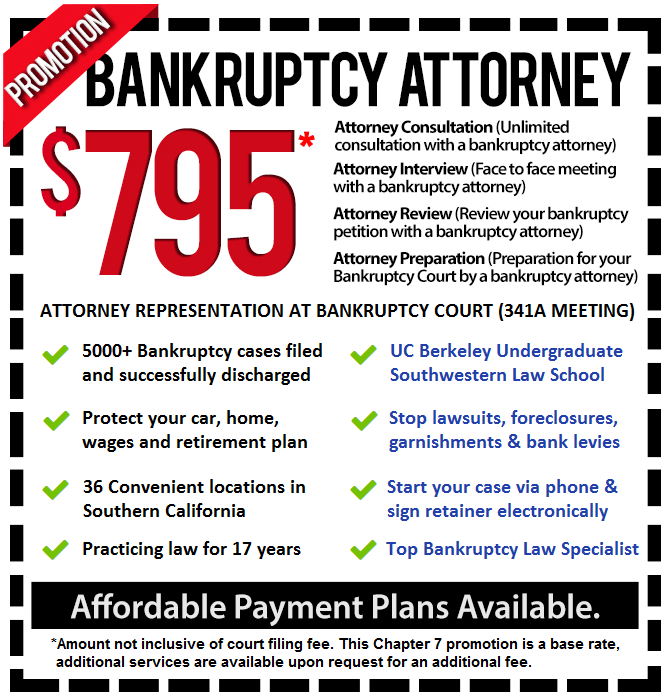

A Chapter 7 Bankruptcy Lawyer has to confirm a consumer’s eligibility to file. There are also obligations that a Tustin consumer has before and after filing that a Chapter 7 Bankruptcy Lawyer will ensure compliance. Filing consists of a petition of your financial affairs that a Chapter 7 Bankruptcy Lawyer prepares and submits for review by a trustee at a meeting that you and your Chapter 7 Bankruptcy Lawyer will attend.

Most cases are discharged about 60 to 90 days later.

Chapter 13 Bankruptcy

A Chapter 13 Bankruptcy Attorney may advise some Tustin debtors that Chapter 13 is their only available option. There are debt limits that a Chapter 13 Bankruptcy Attorney will review but they are substantial.

This is a repayment proceeding where a Chapter 13 Bankruptcy Attorney prepares plan to pay back creditors over 3 years in most cases but in 5 years in some matters. By filing, you can avoid collection activities such as seizures, repossession and foreclosures. Past due payments for a a mortgage, auto loan and other obligations can be included in the plan.

A Chapter 13 Bankruptcy Attorney can also adjust secured debt for inclusion in the plan. You make a single monthly payment to a trustee over the life of the plan. Your Chapter 13 Bankruptcy Attorney can advise you about lien stripping as it pertains to junior mortgages.

Chapter 11 Bankruptcy

For Tustin corporations, LLCs and partnerships, reorganization may be preferred to a dissolution if so advised by a Chapter 11 Bankruptcy Lawyer. Under this filing, a Chapter 11 Bankruptcy Lawyer proposes a reorganization plan that adjusts debt, places creditors in classes and has a restructuring strategy. Certain creditors vote on whether to confirm the plan and will look at its feasibility, fairness and benefits to them.

If confirmed, the company retains its assets and ability to continue its daily operations on its own. However, major business decisions to reduce or expand operations, buy companies, sell off major assets or equipment and to re-negotiate current contracts must be court approved.

During the process, a Tustin bankruptcy lawyer will ensure the company complies with its reporting and filing obligations.

Call a Tustin bankruptcy lawyer at (888) 754-9877 about the bankruptcy process and its potential benefits to you.