Orange Bankruptcy Attorney

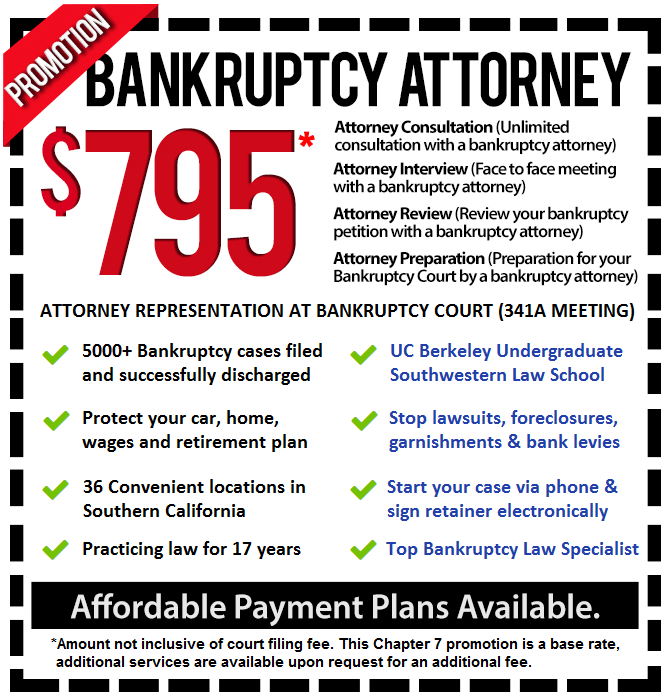

Bankruptcy can be a solution for persons and businesses entangled in debt that is threatening them with loss of valuable assets, liens on property and deficiency judgments. Orange residents and business owners can consult with an Orange bankruptcy attorney at (888) 754-9877 to see if bankruptcy can help them find significant relief.

There are 3 main types of bankruptcy that a Orange bankruptcy attorney handles. Chapter 7 is a liquidation where assets are sold off and used to satisfy creditor claims to some extent though consumers are entitled to a number of asset exemptions that an Orange bankruptcy attorney can assess. Most unsecured debt can be discharged in a Chapter 7.

Another option is Chapter 13, a repayment proceeding where assets are not surrendered and creditors are paid back in installments over 3 or 5 years. An Orange bankruptcy attorney may advise businesses on Chapter 11, a reorganization plan that also repays creditors over time, adjusts debt and allows a business to restructure its operations.

Contact an Orange bankruptcy lawyer about any of the types of filings and their availability

Chapter 7 Bankruptcy

If you are an Orange consumer with severe debt such as substantial credit card charges, medical bills, department store bills, personal loans, promissory notes, business debt, payday loans and repossession deficiencies among others, then you may consider filing. A Chapter 7 Bankruptcy Lawyer must confirm your eligibility based on income or if you can pass a means test. Your assets and their potential loss is also reviewed by a Chapter 7 Bankruptcy Lawyer to see if Chapter 13 might be more suitable.

If your business or corporation is filing, most will have to cease operations while business assets are sold off to pay off creditors.

All consumers have certain obligations to fulfill that a Chapter 7 Bankruptcy Lawyer will advise on before filing a petition of financial affairs. This is reviewed by a trustee at a 341a Meeting that you and the Chapter 7 Bankruptcy Lawyer attend.

In most cases, expect a discharge about 60 to 90 days after this meeting.

Chapter 13 Bankruptcy

A Chapter 13 Bankruptcy Attorney might advise you to file under this chapter if you risk loss of assets from foreclosure or repossession or surrender to the trustee. Also , consumers whose income is too high may file. A Chapter 13 Bankruptcy Attorney drafts a repayment plan that includes your liabilities and past due payments for mortgages, car loans, student loans and support payments. Consumers make a single monthly payment to the trustee for distribution over a 3 or 5 year period.

By having a Chapter 13 Bankruptcy Attorney file, Orange homeowners can avoid foreclosure and others can avoid penalties for late payments. A Chapter 13 Bankruptcy Attorney can also adjust debt that can save you money. Sole Proprietors can include business debt if they personally guaranteed it.

Chapter 11 Bankruptcy

Businesses that wish to remain in operation can file Chapter 11, a reorganization procedure that also adjusts debt and repays creditors over time. A Chapter 11 Bankruptcy Lawyer submits a reorganization plan to certain creditors and equity holders for confirmation who judge it on feasibility, fairness, good faith and if beneficial to them.

If confirmed, the debtor business retains control over its assets and daily operations. However, any decisions such as expanding operations, buying another company, selling off major assets or equipment or any other major business decision must be court approved. A Chapter 11 Bankruptcy Lawyer ensures the business complies with filing and reporting requirements.

Smaller businesses that file can avoid some of these reporting and filing obligations with the assistance of an Orange bankruptcy lawyer who can put them on a fast track.

Call an Orange bankruptcy lawyer at (888) 754-9877 for an in-depth analysis of how bankruptcy could help your financial situation.