Santa Ana Bankruptcy Attorney

No one wants to listen to creditors constantly asking for payment or have to plead with a mortgage lender to give you more time to make up payments or even risk foreclosure. You do have a possible solution, however, by calling a Santa Ana bankruptcy attorney at (888) 754-9877.

Bankruptcy is a process where individual debtors and businesses can be rid of burdensome debt. Under Chapter 7, assets have to be sold off to pay off creditors to some extent though consumers can have personal assets exempt if they meet certain exemption amounts that a Santa Ana bankruptcy attorney will review. Individuals also have to meet certain income and liability criteria to file Chapter 7 or Chapter 13 that a Santa Ana bankruptcy attorney will confirm.

Chapters 13 is a debt repayment proceeding for individuals and sole proprietors. A business can choose to dissolve under Chapter 7 or reorganize under Chapter 11. If considering bankruptcy, consult with a Santa Ana bankruptcy attorney about how the process works.

A Santa Ana bankruptcy attorney can handle any of the 3 most common types of bankruptcy.

Chapter 7 Bankruptcy

This is a straight bankruptcy where a business can liquidate its assets to pay off creditors and not have any deficiencies to make up. Santa Ana consumers have to meet income criteria that a Chapter 7 Bankruptcy Lawyer will verify. The Chapter 7 Bankruptcy Lawyer will also review your personal assets for non-exempt status.

Unsecured debt such as credit card charges, medical bills, department store bills, personal loans, promissory notes, business debt, payday loans and repossession deficiencies among others can be discharged in Chapter 7. There is unsecured debt that is not dischargeable that a Chapter 7 Bankruptcy Lawyer will advise you.

Santa Ana individuals have certain obligations regarding financial disclosures and attending certain classes that a Chapter 7 Bankruptcy Lawyer will ensure your compliance with before a discharge will be granted.

Chapter 13 Bankruptcy

Individuals who are not eligible under Chapter 7 can still file Chapter 13 after consultation with a Chapter 13 Bankruptcy Attorney. You repay creditors over 3 years in most cases and over 5 years if good cause is shown. Santa Ana residents can avoid foreclosure or other repossession by including arrearages in a plan composed by a Chapter 13 Bankruptcy Attorney. You can also include past due payments for a student loan, auto loan, alimony or child support obligation.

A Chapter 13 Bankruptcy Attorney can adjust secured debt to save you money. Sole proprietors may include business debt in the plan provided they personally guaranteed it. If a Chapter 13 Bankruptcy Attorney advises you, then consider this as an alternative option since you can save valuable assets.

Chapter 11 Bankruptcy

A Santa Ana business that is struggling to pay creditors may consider filing for reorganization under Chapter 11 after consultation with a Chapter 11 Bankruptcy Lawyer. Chapter 11 is also a repayment process where a Chapter 11 submits a reorganization plan that places creditors in classes and advises them on how much they will be paid over time and how the company will restructure its operations. Certain creditors whose obligations would be impaired under the plan vote to confirm or reject it.

Once confirmed, the debtor company retains control over its assets and daily operations but its plans to expand operations, break existing contracts, re-negotiate others and to seek financing must be court-approved.

A Santa Ana bankruptcy lawyer ensures company compliance with reporting and filing requirements. With the assistance of a Santa Ana bankruptcy lawyer, smaller businesses can bypass some of these requirements. Individuals can file Chapter 11 also under certain circumstances.

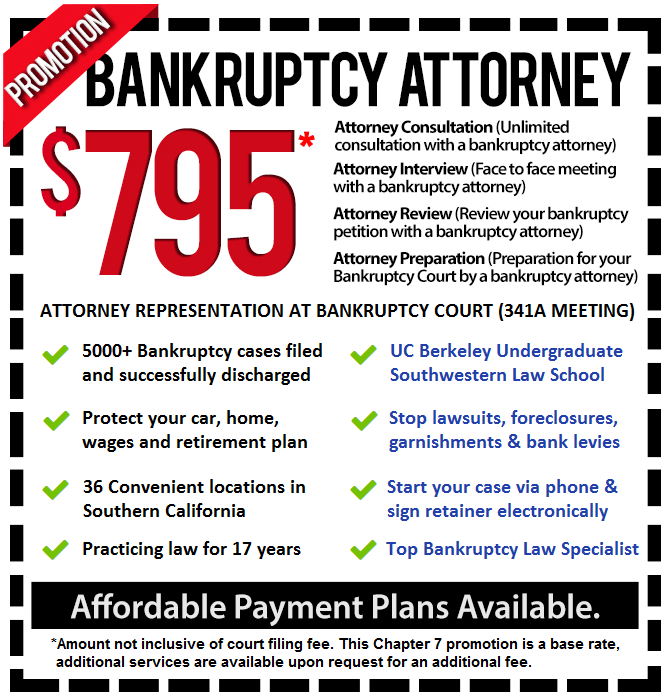

Call a Santa Ana bankruptcy lawyer at (888) 754-9877 to see how bankruptcy can relieve you of intensive debt and get you back on track.